Impressive Tips About How To Develop A Personal Budget

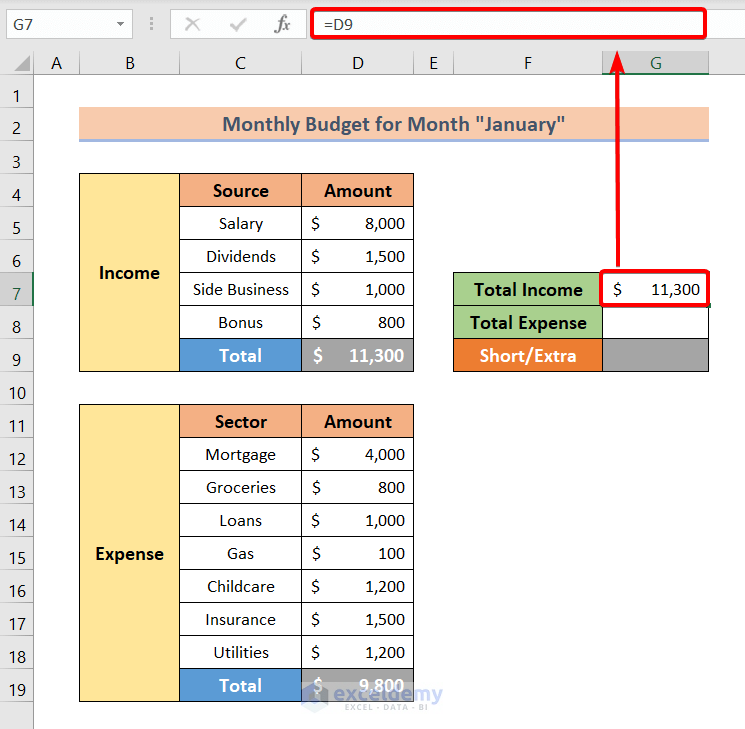

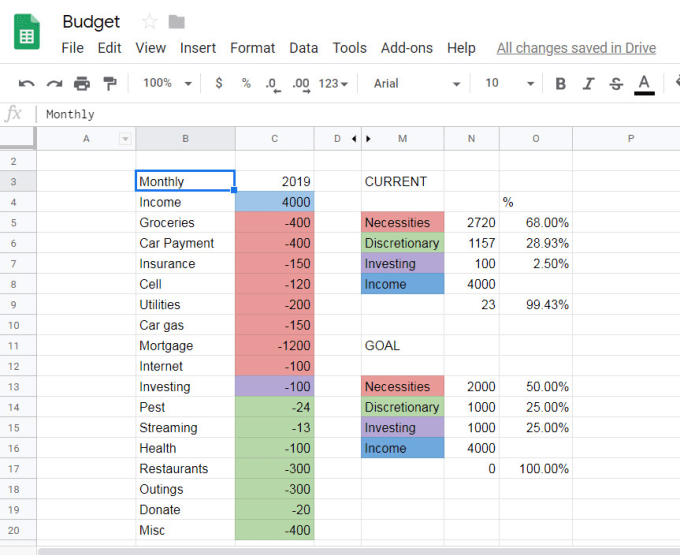

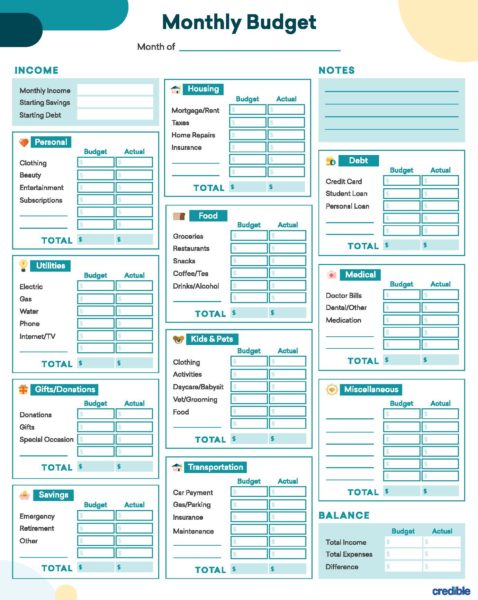

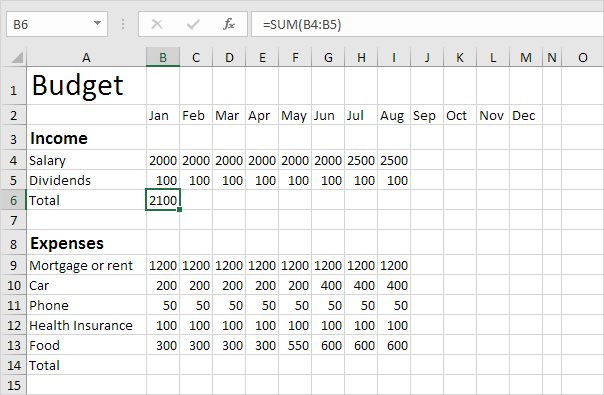

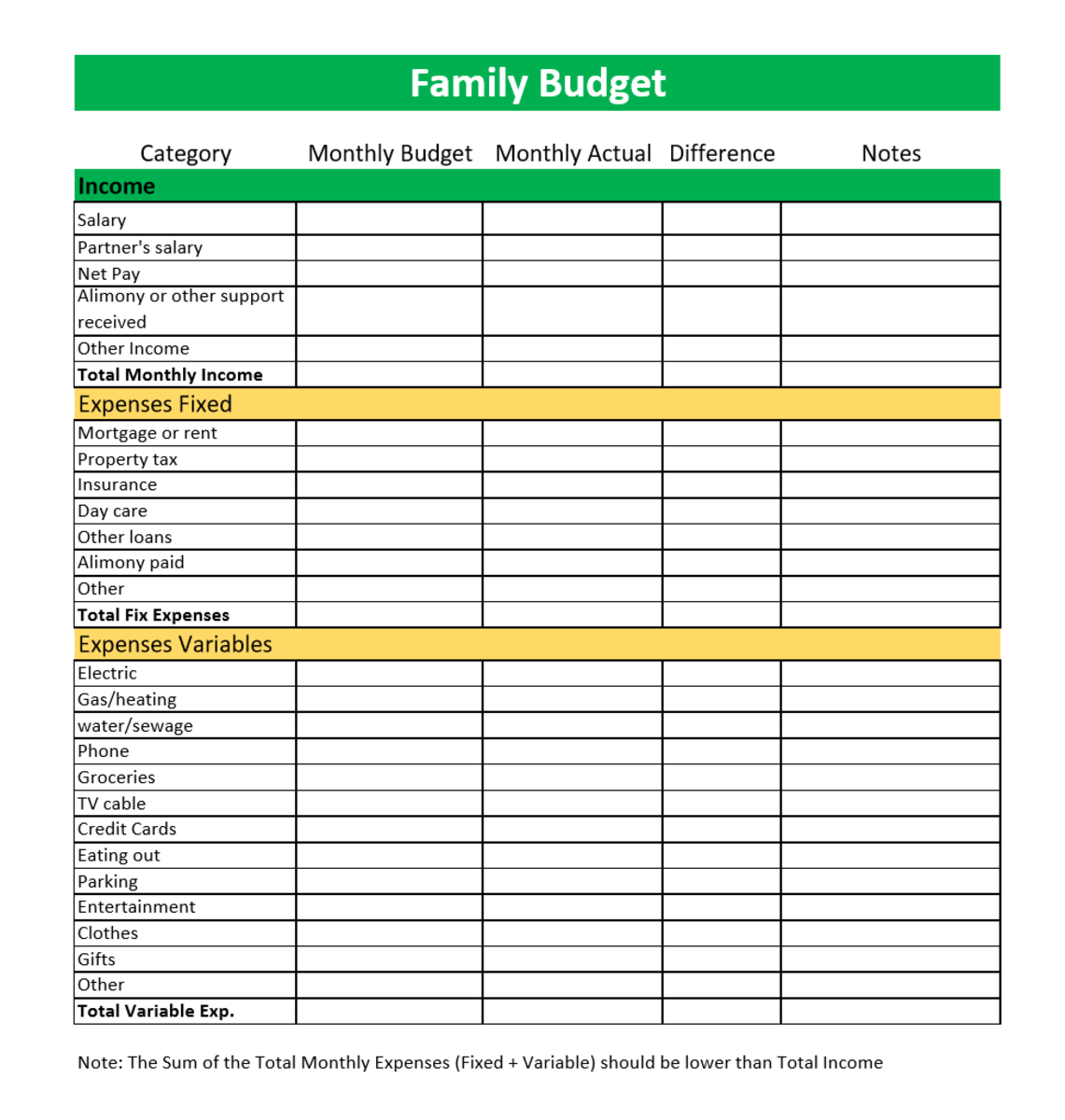

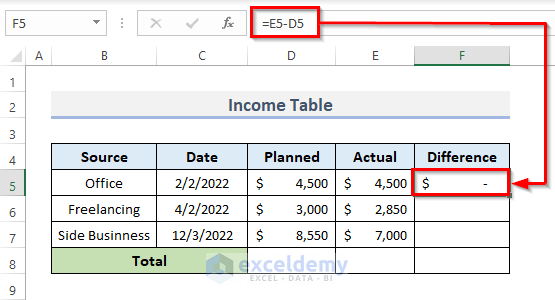

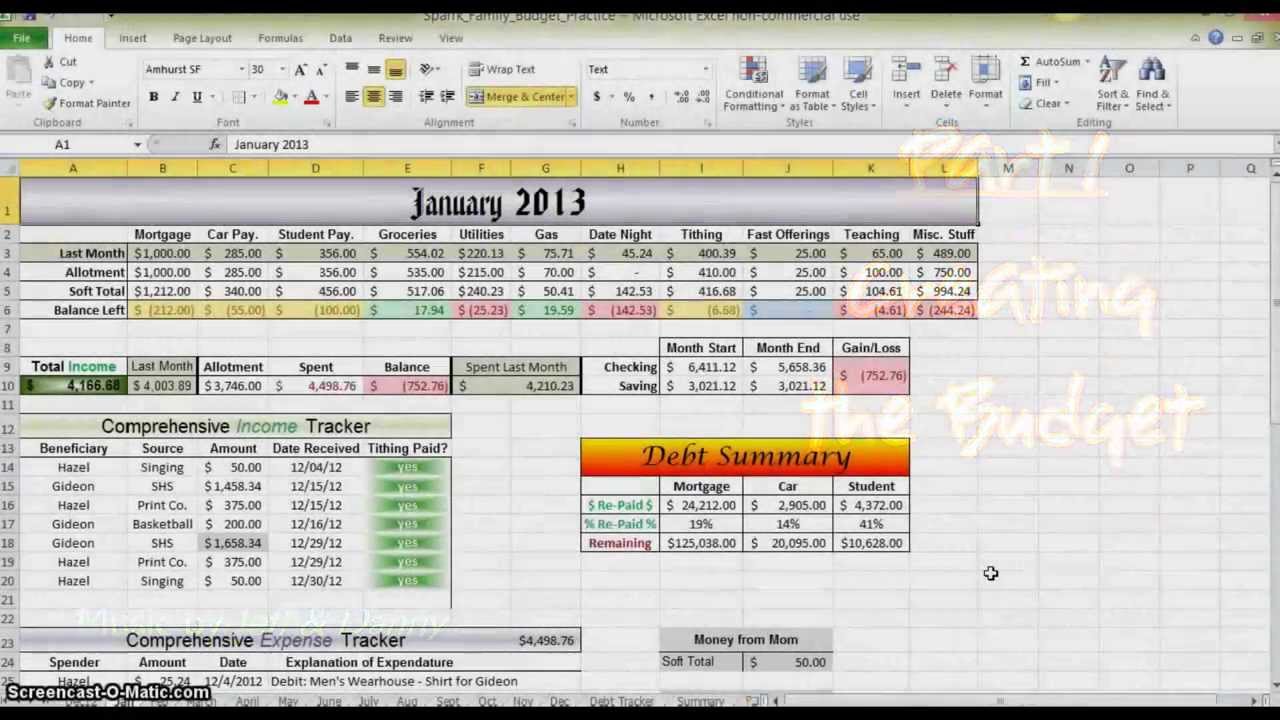

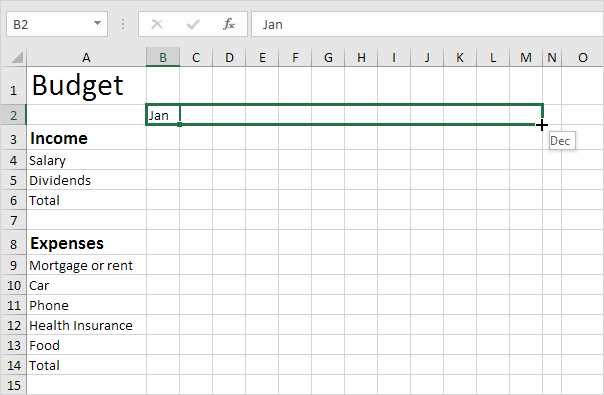

Add up the monthly income you expect from all sources categorize and add up the monthly expenses you expect to pay.

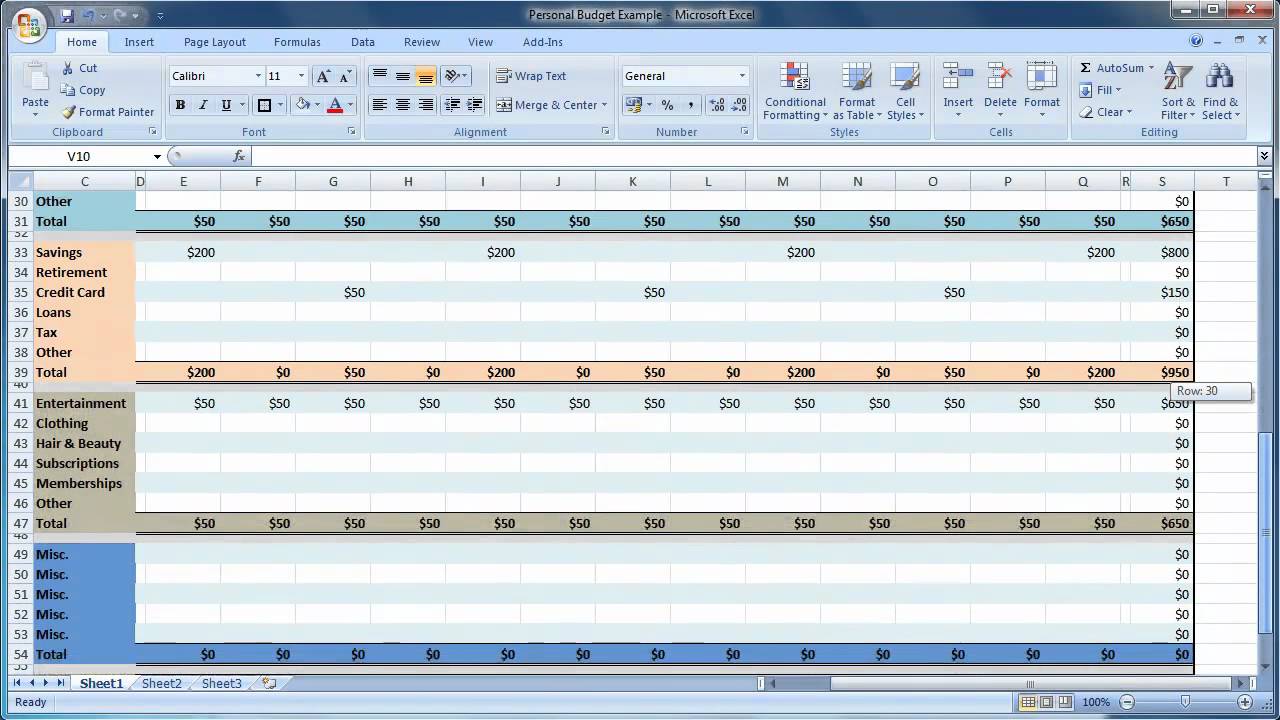

How to develop a personal budget. Learn when the game is live & learn valuable financial lessons like tackling student debt Then add whatever lines you need for that. Update your budget with any changes, for example, a pay raise, a bill increase, etc.

Use how often you get paid as the timeframe for your budget. Next, estimate how much you may spend per month on variable. If you’re trying to decide if an expense is intermittent, check your budget and see if you paid the cost last month and the month before.

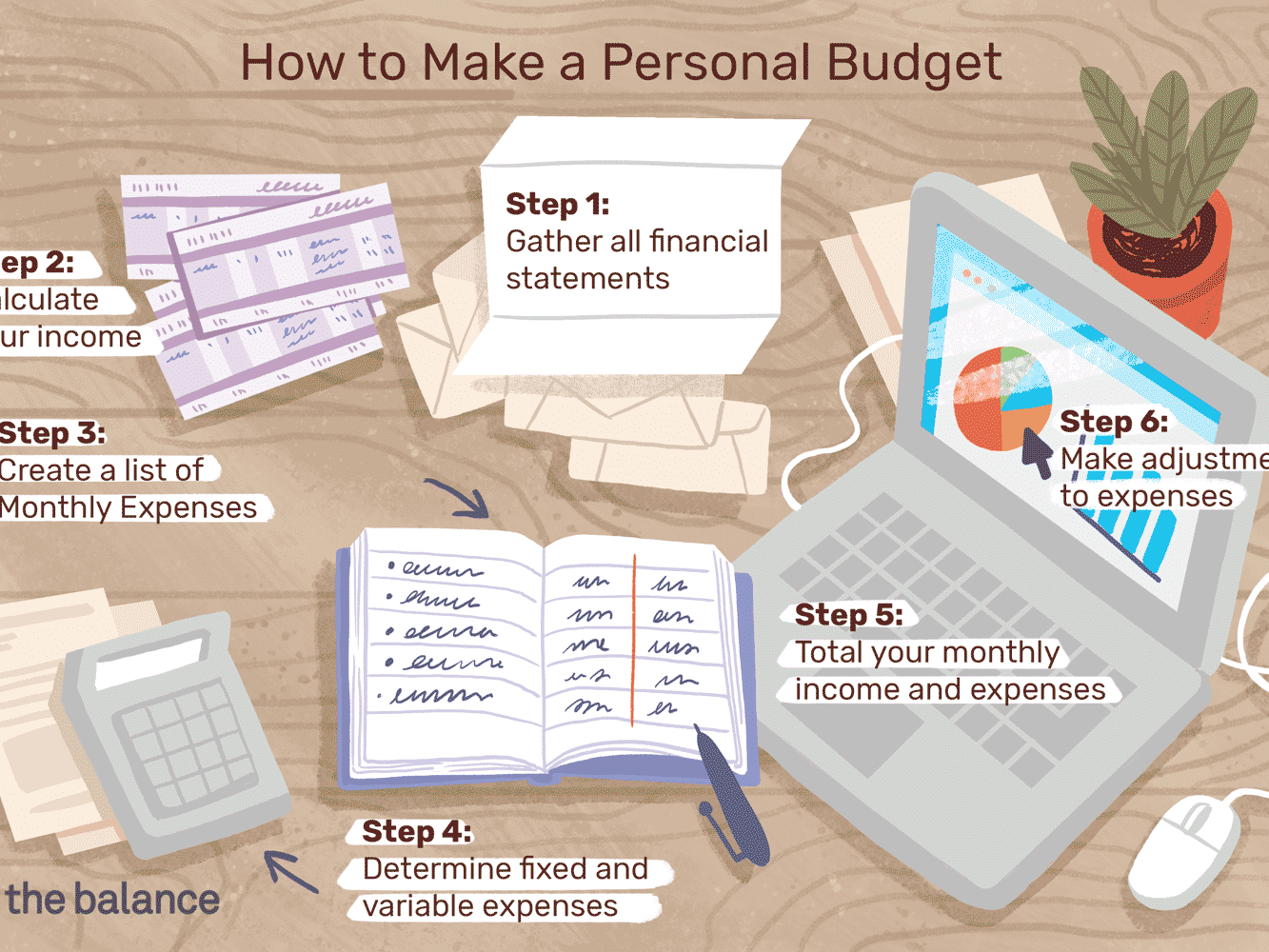

How to make a budget gather your financial statement. One popular budgeting strategy is the 50/30/20 rule, which separates your spending by category: Learn when the game is live & learn valuable financial lessons like tackling student debt

That may mean letting go of a bag of chips and a half gallon of ice cream. Keep all your receipts and bills. Limit your spending as much as possible to what is in your budget.

Ad learn more about our free interactive game about lifelong financial lessons. Before you can dig into personal budgeting, you need your financial information. Use this worksheet to see how much money you spend this month.

Then check your annual spending. Begin with your fixed expenses and assign a spending value to each category. The basic process for making a budget goes like this: